uber eats tax calculator uk

Only customers based in the UK will receive rewards. Your annual tax summary will be available by January 31 2022 on the Tax Information Tab of the Driver Dashboard.

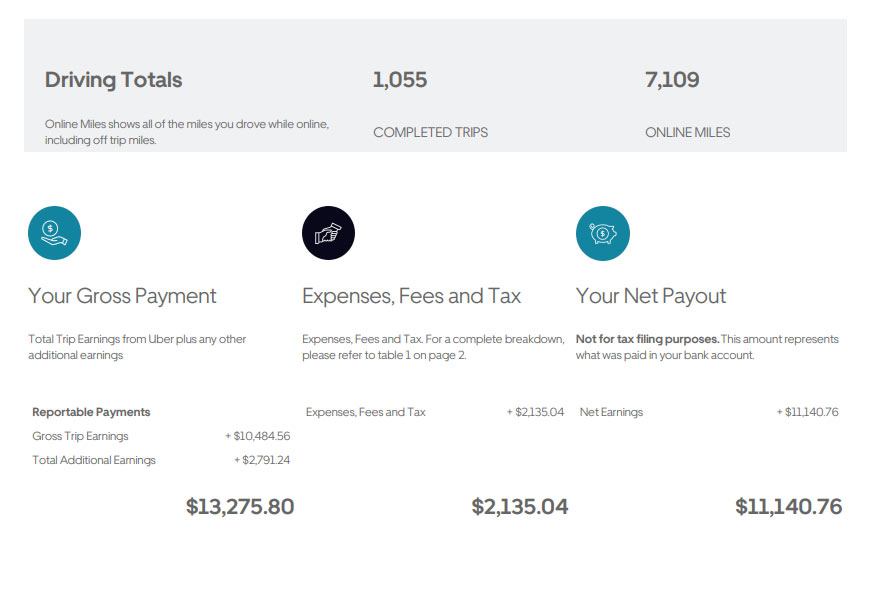

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

My car is old 2007.

. Uber Eats will not entertain missing claims queries. I recieved summary from Uber I am still confusing with about fare breakdown 8000 and potential deduction uber service fee 3000 how much should I put on my tax declaration 5000 or 8000 with 3000 deduction. So you pay 153 of this so called self employment tax.

In most cities Uber is designed to be a cashless experience. First there is a base fare of payment that considers order pick up the order drop off the time spent delivering the food and the distance traveled. You can log into your Uber profile and input your number by following these instructions.

Uber tend to document how much you earn very well so I cant see filling out a self assessment. However in my bank account I received 18910 and therefore I also received 2433 in incentive payments. Uber Self assessment tax return.

Once youve tried it out check out our list of 16 Uber driver tax write offs to see how you can save more on your year-end taxes thereby increasing your true profit. Uber Eats Fee 18024. You make estimated quarterly payments without needing any documents from Uber.

The main one of course is your vehicle. Taxi fare estimator for Uber more. The tax on your security job will come out of PAYE.

Find the best restaurants that deliver. Total Payment 44360. On my business turnover should i declare the amount before 25 fee of uber and declare fee as an expense or should i declare the actual money i received on my bank account after uber fee.

Order food online or in the Uber Eats app and support local restaurants. Fees paid were 8871. How to Calculate Your Tax.

Enter your data and sit tight for your reaction. Uber Eats essentially pays its food delivery drivers a certain amount for every delivery. Uber drivers incur expenses some of which can be deducted to reduce your tax liability provided they are made solely for business purposes.

Hello i am self employed as an uber driver started last year. Reward only given on your first order from new customers only. While some states are trying to change that Uber retains its autonomous drivers.

The gross amount I will use in my tax return will be what I received in my bank 18910 the uber fee 8871 18910 8871. But confused which method will be used for UK hmrc income tax submission. Lets presume that i had only one trip of 10 Gbp fare from.

Only show this user. I do not work too much as I do a job in day time. Rewards are not calculated on postage handling delivery costs or associated purchase taxes in your region This may include but not be limited to VAT GST etc.

Get contactless delivery for restaurant takeaways food shopping and more. Income tax starts at 20 on all your income not just from Uber over 12500 and 40 over 50000. These common tax deductions can significantly reduce your tax liability.

I am doing uber eats and need to lodge my tax. With our tool you can estimate your Uber or Lyft driver taxes by week month quarter or year by configuring the calculator below based on how much and how often you plan to drive. This number reflects the IRSs 56 cents per mile minus your fuels costs.

You neednt bother with a higher education or exceptional range of abilities to drive Uber Eats yet you should meet the drivers prerequisites. It for the most part takes 24-48 hours yet now and then more. To qualify as a driver you should be 19 years.

Uber Eats Tax Post by RMC Sun Oct 08 2017 1108 am From 201718 there is a new 1000 allowance for property and trading income so if you receive less than that from your new trade the only good reason to prepare accounts and file tax return would be if you make trading losses and want to claim loss relief. The price estimate for each ride option will appear. Youll need to send a self assessment and register as a sole trader with HMRC when this tax year is coming to an end if youve earned over 1000 through UberEATS.

This Is How Much You Spent in Depreciation Wear Tear and Other Expenses. Weekly hours like 221224243. As a self-employed taxpayer you can claim tax deductions that can reduce your tax bill.

The time spent delivering and the mileage traveled impact the final earnings of an Uber driver. As of 202021 Class 4 is paid at 9 on profits between 9501 and 50000 and at 2 on any profits above 50000. Scroll to see.

So now we will talk about Uber driver tax deductions UK. Because I actually only earn 5000. Youll now see a yearly total of online miles logged.

If you are responsible to collect sales tax based on this threshold you will need to provide Uber Eats your HSTGST registration number. Net Sales 42034 Vat Adjustment 2326. You still only file your tax return once after the end of the year.

Then you also pay income tax just like an employee but only on 80 of your profits if you make over 12k. Go to the tab Invoice Settings. How do I get a price estimate in the app.

Open the app and input your destination in the Where to box. DEDUCT YOUR BUSINESS EXPENSES. In cities where cash payments are available this option must be selected before you request your ride.

I am doing uber eat using my car part time. Simplified or total expenses. Uber Eats the drivers eequirements.

This includes miles spent waiting for a trip on your way to pick up a rider or an order placed via Uber Eats and on a trip. The amount of tax and national insurance youll pay will depend on how much money is left over after deducting your Uber expenses tax allowances and reliefs. Discussion Starter 1 Jan 27 2019.

Drive For Ubereats In Kitchener Waterloo Waterloo Rustic Farmhouse Kitchen Rustic Farmhouse Kitchen Cabinets

What S In The Bag Trialing A New Way To Calculate The Cost Of Delivery Uber Newsroom

Epic Packing List Packing List Travel Pictures Travel Design

Driver Pay And Sign Up Requirements For Uber Eats In Kingston Uber Delivery Driver Uberx

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber Eats 15 Gift Card Email Delivery Newegg Com

13 Ways To Pay Off Your Mortgage Years Sooner Paying Off Credit Cards Credit Card Debt Relief Credit Card Readers

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Is Driving For Uber Worth It 7 Things To Know Pay Salary

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

How To File Taxes For Uber As An Independent Contractor Filing Taxes Independent Contractor Uber Driving

Happy Chartered Accountants Day Motivational Picture Quotes Day Wishes Chartered Accountant

Uber Eats 15 Gift Card Email Delivery Newegg Com

Uber Eats 15 Gift Card Email Delivery Newegg Com

Uber Reporting Income And Filing Taxes Senathi Associates

Is Driving For Uber Worth It 7 Things To Know Pay Salary

Do I Owe Taxes Working For Ubereats Net Pay Advance Payday Loans Online Payday Advance